Something seems amiss at Zepto. In a matter of days, the quick commerce giant went from raising a massive $450 Mn to laying off 200-300 employees. Besides, it plans to continue trimming its workforce till the end of the year.

At a cursory glance, the two developments seem at odds. However, underneath the equation lies an uncomfortable truth — the massive funding is less of a victory lap and more of a lifeline for the company.

Amid a slowdown, Zepto has been restructuring operations and deferring its IPO (initially planned for this year). With the fresh funding, the startup plans to claw back its market share and expand aggressively once again.

But, how difficult is it going to be for the startup that is valued at $7 Bn to claw back its position otherwise lost to the likes of Blinkit and Instamart? Now, before we answer that, here’s how Zepto, which raised around $2 Bn in just three years, lost its footing in the first place.

Has Zepto Lost Its Mojo?The answer to this lies in its diversification bets. The company tried to move beyond groceries with Zepto Cafe, a quick snack delivery vertical. But after an initial splash, the cracks began to show.

Growth plateaued, and orders started shrinking. Founder Aadit Palicha, who was once vocal about the vertical’s quarterly performance on social media, has gone silent since February this year.

The startup has since shut down over 50 outlets across multiple cities. The order volumes have halved from a peak of 1 Lakh daily.

Zepto faced another setback when chief experience officer (CXO) Shashank Sharma, who was overseeing Zepto Cafe operations, quit last week to join Foodstores, a move that insiders interpret as a signal that Zepto Cafe is no longer a strategic focus.

According to a person aware of internal developments, several senior-level leaders have exited Zepto Cafe while more cafes are being shut each month.

Adding to the challenges, the rise of Swish and competition from Bistro and Snacc further chipped away at Zepto Cafe’s market share. This has forced Zepto to rethink its vertical strategy and consolidate operations.

Zepto’s other experiment, Zepto Medicine, has also struggled to find its footing. After scrapping its first launch last year over supply chain issues, the service re-emerged in August in limited cities.

This vertical will take some time to contribute meaningful revenue, especially at a time when Tata 1mg and Apollo Pharmacy have already started delivering prescription-based medicine within 15 min to 1 hr.

All of this means that Zepto will now have to return to its core — groceries. However, the startup’s immediate priority is to strengthen its dark store network, expanding into new localities while ensuring existing stores inch closer to profitability. But that’s easier said than done.

Industry insiders say it typically takes 12-18 months for a dark store to break even, depending on the locality and order density. That timeline translates to a prolonged cash burn for Zepto, especially as it continues to open new stores to protect market share from Blinkit and Swiggy Instamart.

Long story short: Zepto is caught in a growth trap. Expand too fast, and it burns cash; move too slowly, and it risks losing key markets to competitors.

This explains why Zepto has noticeably reduced the pace of new dark store launches, a stark contrast to the rapid rollout phase that once fuelled its rise.

Momentum Stalls Amid Rival SurgeUntil the end of last year, Zepto, the newest entrant in India’s quick commerce race, had managed to punch above its weight, cornering 29% of the market, ahead of Swiggy Instamart’s 24%, while Blinkit remained the clear category leader with a 46% market share.

At the time, Zepto’s operational footprint looked strong — it operated around 650 dark stores, slightly higher than Instamart’s 609, and marginally behind Blinkit’s 719.

For a brief period, Zepto had cemented its position as the second-largest player in the space, signalling that it was no longer the underdog.

Cut to 2025, the momentum appears to be fading.

According to a BofA Securities report, Blinkit has expanded its market share to over 50%, while Instamart’s gross order value (GOV) rose 22% sequentially in Q1FY26, outpacing the sector’s sequential growth of sub-20%.

The numbers imply that both Blinkit and Instamart have eaten into Zepto’s share, now estimated at 23-25%. Meanwhile, Tata BigBasket, Flipkart Minutes, and Amazon Now collectively control a modest 5-7% slice of the market.

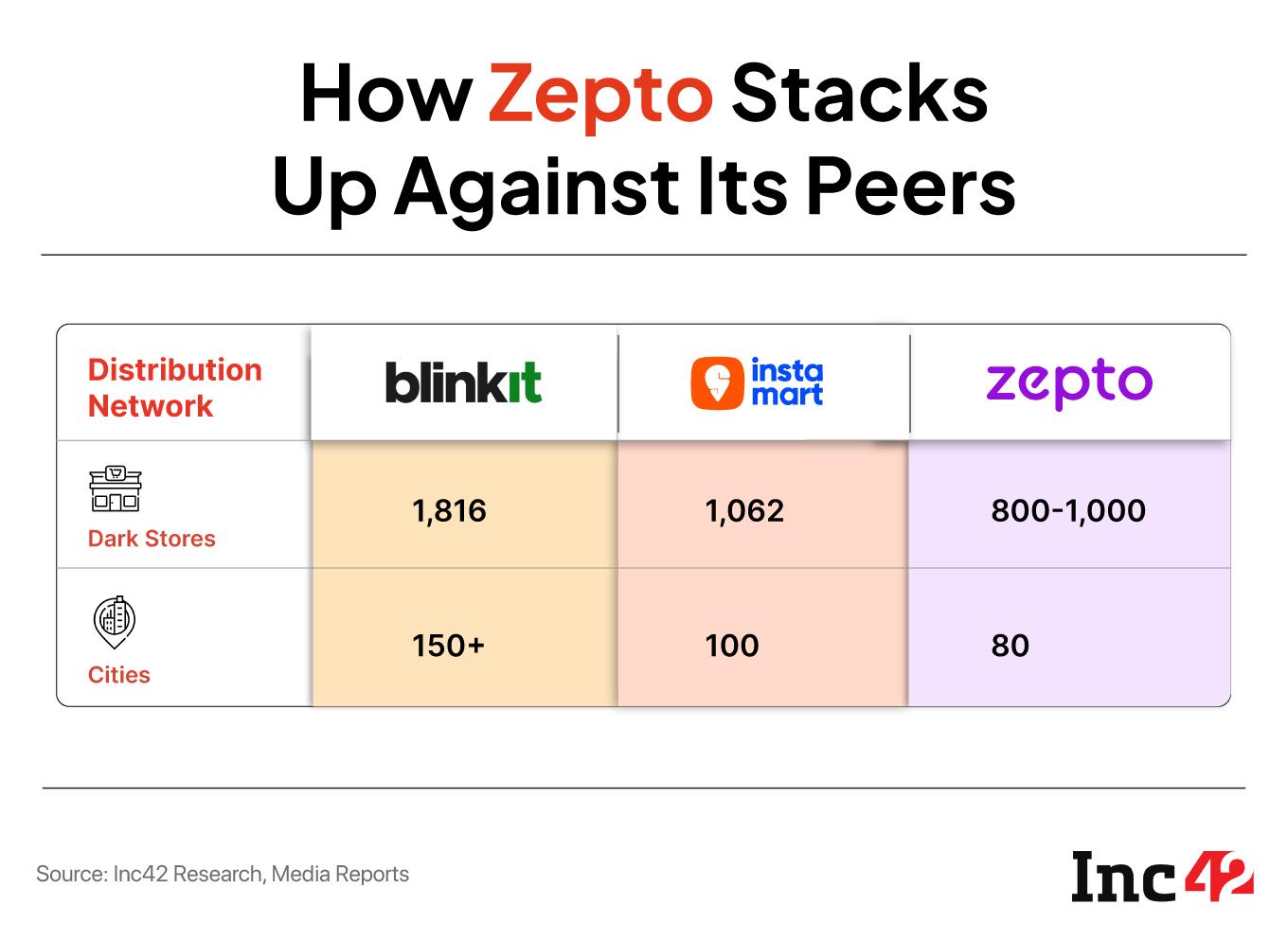

The gap widens further when one looks at infrastructure. As of September 2025, Blinkit operated around 1,814 dark stores and has set an ambitious target of 3,000 stores by March 2027.

Instamart, Zepto’s closest rival, surpassed it with over 1,062 dark stores at the end of the June quarter. In comparison, Zepto’s count stands between 800-1,000, reflecting a noticeable slowdown in expansion. Moreover, both Blinkit and Instamart are present in more cities, giving them broader coverage and stronger delivery density.

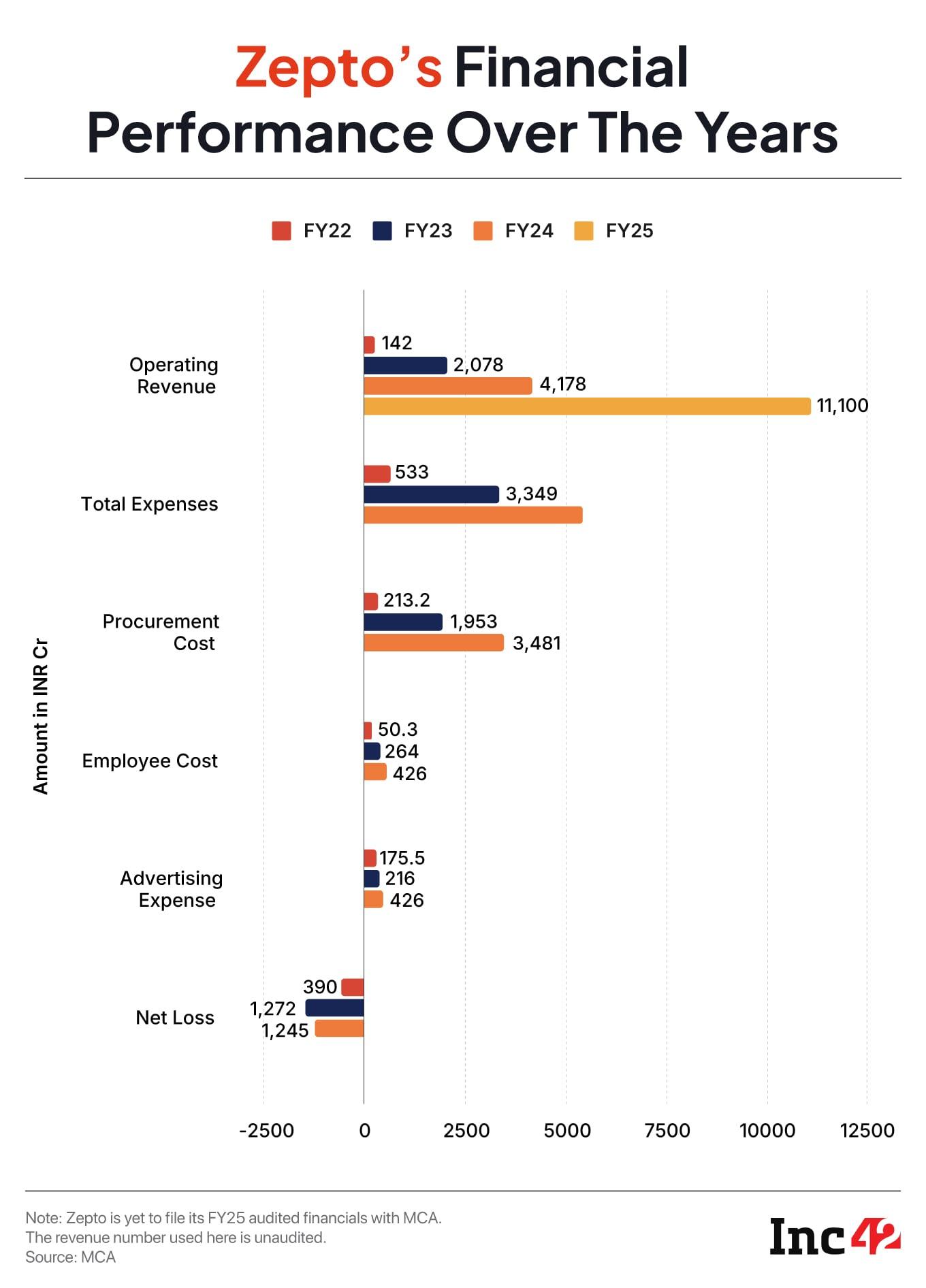

On the revenue front, Zepto’s FY25 top line reportedly jumped 150% YoY to INR 11,110 Cr, an impressive number, but that is only one side of the story. Unlike its rivals, Zepto’s revenue accounting does not represent direct sales in the same way as Blinkit or Instamart.

For context, Blinkit’s gross order value stood at INR 28,274 Cr in FY25, while Instamart’s GOV reached INR 14,600 Cr.

What’s more, Blinkit’s strategic shift to an inventory-led model is already showing tangible results. The Eternal-owned company saw its operating revenue surge 9X YoY to INR 9,891 Cr in Q2 FY26, driven by a 137% spike in order volumes. The model gives Blinkit better control over margins.

Instamart, too, is treading a similar path. The company recently spun off its quick commerce vertical, signalling the start of a transition toward an inventory-based model.

According to a company insider, Instamart is also exploring a capital raise to boost its domestic shareholding and qualify as an Indian owned and controlled company (IOCC), a move that could pave the way for QIP fundraising. This dual advantage of fresh capital and tighter supply control further tilts the scales in Instamart’s favour.

Zepto, on the other hand, has been attempting a similar shift since last year, looking to increase domestic ownership to gain greater operational control. However, with the latest foreign capital infusion, that transition may face delays, potentially leaving Zepto a step behind as its rivals solidify their inventory-led advantage.

Back To Expansion And BasicsFor Zepto, the path forward will demand a mix of discipline and restraint, two things the startup historically hasn’t been known for.

To begin with, Zepto must rein in its spending. It was reportedly burning close to INR 250 Cr per month to acquire users and fund deep discounts and has now managed to bring that figure down to double digits. That’s a step in the right direction, but sustaining this discipline as it re-enters an expansion phase will be the real test.

Zepto will also need to put its focus on its core vertical. “Zepto is at a stage where it needs to pick its battle, either scale Zepto Cafe or its core business. It can’t do both,” an analyst said.

Next, Zepto must work on lifting its average order value (AOV), a critical lever to improve unit economics. While rivals have managed to grow their AOV by widening their product assortment and pushing premium categories, Zepto still lags on that front.

As of mid-2025, Blinkit’s AOV stood at INR 669, Instamart’s at INR 612, while Zepto trailed at INR 550. Unless Zepto finds a way to increase its wallet share per user, it risks burning more cash without meaningful margin improvement.

Third, the startup has to push for store-level profitability, especially across metro cities, its strongest demand centres. Blinkit, for instance, has already claimed an adjusted EBITDA margin of 2.5% in major cities in Q1 FY26, with a potential to hit 6% over the long term. Zepto needs a similar breakthrough to convince investors that its model can scale profitability.

Another key area is brand perception. Zepto has often drawn criticism for its dark patterns, including hidden pricing and inconsistent product rates across regions. This is also one of the primary reasons why its download numbers have plummeted.

The startup has revamped its app interface recently to address these issues, but consistency will be crucial, especially now that it has fresh capital to deploy. The startup further needs to increase its ad revenue while working alongside D2C brands in the space.

With a cash balance of roughly $900 Mn (INR 7,900 Cr) post the fundraise, Zepto is expected to step on the gas once again.

Founder Aadit Palicha plans to open a “a few hundred” new dark stores, a move that signals an imminent return to high-growth mode. But expansion comes with a familiar trade-off – higher discounts and renewed cash burn.

The immediate concern is that Zepto’s renewed growth push could reignite losses just when the company is prepping for an IPO. Public investors have become far more cautious, especially as listed peers are cutting losses and improving contribution margins. A high burn growth story might no longer be an easy sell to public markets.

Meanwhile, there’s another storm brewing. Reliance’s JioMart, which is adding 400 dark stores and foraying deeper into quick commerce, could reshape the competitive landscape altogether.

For Zepto, already battling to defend its turn against Blinkit and Instamart, this may be its most formidable challenge yet.

Edited By Shishir Parasher

The post Zepto’s Expansion Dilemma appeared first on Inc42 Media.

You may also like

Cyclone Montha to bring heavy rain in Bengal, says MeT office

Anupam Kher marvels at Yash Chopra's achievement, captures Jungfrau Railway's 'Yash Chopra Train'

Migrant manhunt LIVE: New image of Epping sex offender released as search enters third day

"Not only working as 'pradhan sewak', but also guiding like a true leader": BJP MP Bansuri Swaraj hails PM Modi

The 'most gorgeous city in Europe' with pretty streets but no tourist crowds