Four years and countless regulatory hurdles later, Tesla has finally arrived in India. The Elon Musk-led EV giant has debuted in the country with two variants of its midsize SUV, Tesla Model Y, starting at a hefty price tag of INR 59.89 Lakhs.

With its first showroom live in Mumbai with plans to expand to Delhi, the company’s road ahead in India may not be a straight drive.

The India Price Puzzle: For starters, Tesla’s premium offerings may have limited takers in the price-sensitive Indian market. Then, there is the significant price disparity. Compared to the nearly INR 60 Lakh price tag in the country, the Model Y is priced much lower in other countries:

- US: INR 40 Lakhs

- China: INR 29.9 Lakhs

- Germany: INR 45.6 Lakhs

The Tax Trap: The biggest roadblock to Tesla’s growth in India is the high local duty on imported cars, which can exceed up to 100% in some cases. Another sword looming over the EV maker is the ongoing tariff wars between India and US and CEO Musk’s souring relationship with US President Donald Trump. Caught in the crossfire, Tesla may have little to no respite on the tax front, especially from its home base.

No “Make In India”? The EV major’s India launch appears more cautious. Instead of availing lower import duties by committing to local manufacturing, Tesla has rather been importing cars to test demand. In essence, the company seems to be gauging consumer interest and the regulatory turf before making heavy investments in India.

A New Market At Play: Tesla’s entry coincides with a rapidly expanding four-wheeler EV market in India. The space is dominated by homegrown giants like Tata Motors and Mahindra & Mahindra while global players like Mercedes Benz and BMW are also scaling up their presence.

But a potentially greater threat comes from its Chinese rival, BYD, which has been making headway in India with its affordable offerings. That begs the question – can Tesla cash in on the high-risk, high-reward opportunity with its India foray?

From The Editor’s DeskWeWork India IPO Gets SEBI Nod: After putting the coworking major’s DRHP in abeyance earlier this year, the market regulator has now greenlit the IPO. The Bengaluru-based coworking giant’s public issue will only comprise an OFS component of up to 4.4 Cr equity shares.

TVS Pumps INR 64 Cr In DriveX: The auto giant has infused more capital into the two wheeler marketplace by acquiring 5,179 equity shares at INR 1.23 Lakh apiece on a private placement basis. TVS owned 87% stake in the marketplace at the end of December 2024.

Fractal’s $170 Mn Secondary Sale: The SaaS startup’s early backer Apax Partners has offloaded 6% stake to a consortium of 22 institutional investors. The deal bumped up the startup’s valuation to $2.44 Bn from $1.55 Bn at which it was last pegged in 2023.

Infibeam Closes Rights Issue: The fintech major closed its INR 700 Cr rights issue with an oversubscription of 1.4X. The proceeds will be utilised to invest in AI-driven products, digital payment solutions, and certain acquisitions.

Will MDR Tide Lift All UPI Apps? Fintech stakeholders have been lobbying the Centre to charge MDR on large merchants for transactions above INR 2,000. But, who among top fintech players will benefit the most from the potential regime?

Trupeer Bags $3 Mn: The AI-based content creation platform has raised the funds from RTP Global, Salesforce Ventures and other angel investors. The startup enables its clients to create high-quality guide or demo videos with GenAI.

Justdial’s Q1 Show: The hyperlocal search engine’s net profit grew 13% to INR 159.7 Cr in Q1 FY26 from INR 141.2 Cr in the year-ago quarter. The company’s operating revenue also rose 6% YoY to INR 297.9 Cr during the June quarter.

Reliance’s Trademark Perils: The Delhi HC has directed seven ecommerce platforms to delist products that infringe upon “Reliance” and “Jio” trademarks. In its plea, RIL alleged that many entities were selling goods online under its trademark without authorisation.

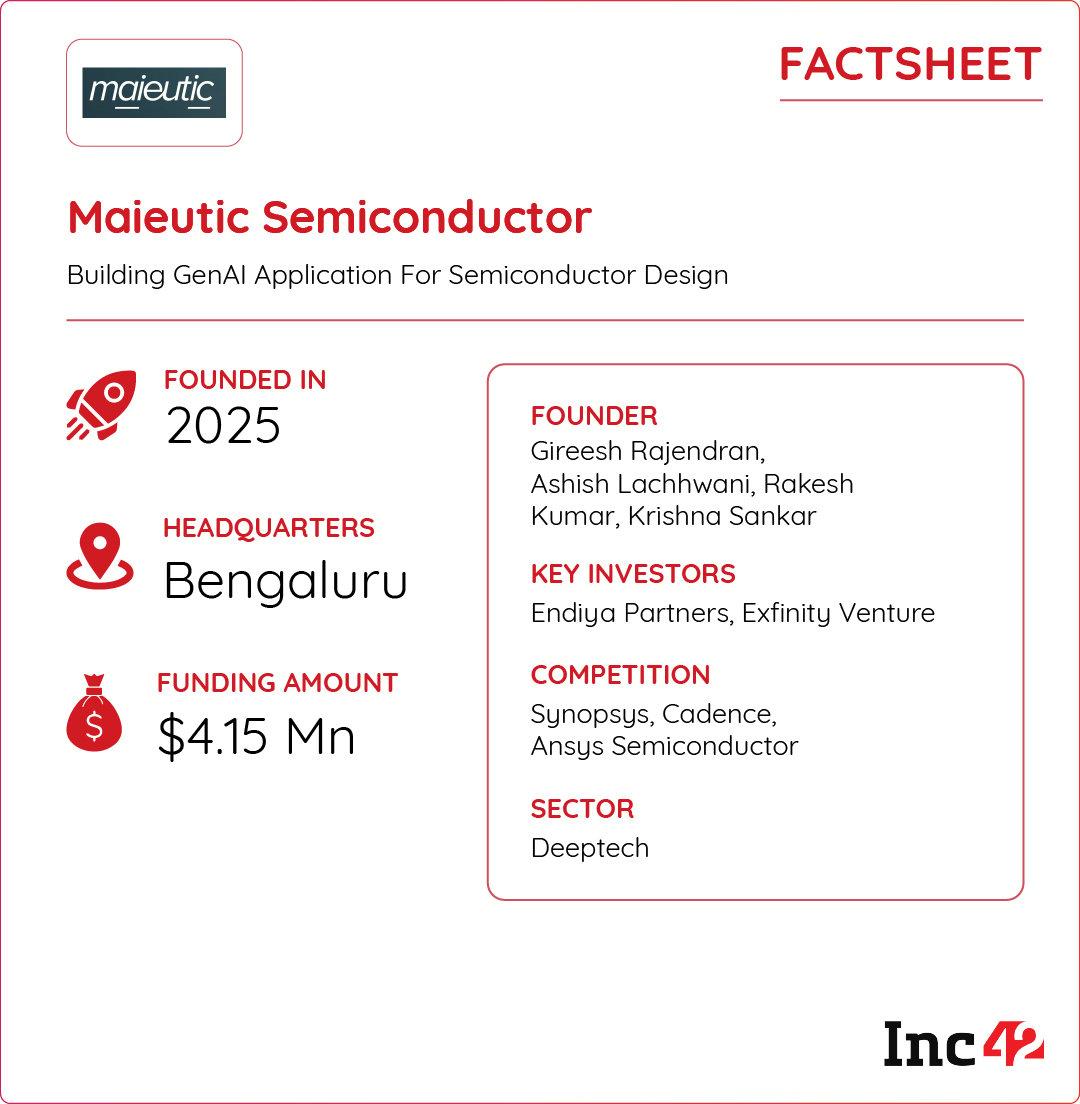

Inc42 Startup Spotlight How Maieutic Is Automating Chip Design With GenAIFor years, analog and integrated chips, critical for almost all electronic items, have been designed via manual processes. Their design cycles can take up to 15 months and more complex projects can go up to 24 months.

To bring this turnaround time down with AI, semiconductor veterans Gireesh Rajendran, Ashish Lachhwani, Rakesh Kumar, and Krishna Sankar founded Maieutic Semiconductors in 2025.

Crafting Chips With AI: The Bengaluru-based startup is harnessing the power of GenAI to automate the process of chip design. Maieutic’s tech stack revolves around leveraging open-source foundational models and fine-tuning them with curated, proprietary datasets. Combining these models with specialised knowledge in analog design, it is building a copilot to help automate the early stages of chip design workflows.

Maieutic’s Wide Horizon: The startup aims to automate the initial part of the designing process by creating use cases for high-demand areas like battery management systems, mixed-signal sensors and wireless technologies. Currently, the startup is speeding up product development and is looking to tie up with global foundries and EDA firms.

Backed with its GenAI prowess, can Maieutic Semiconductors usher in a new era in chip design?

The post Tesla’s India Debut, WeWork India’s IPO & More appeared first on Inc42 Media.

You may also like

'Got very big success': Terrorist killed in Udhampur was top JeM commander, J&K police reveals; vows to continue crackdown

Congress raises honeytrap scandal targeting Maha's high-ranking officers and politicians

Maharashtra CM Proposes Alliance with Uddhav Thackeray Amid Political Shifts

Nagaland State Lottery Result: July 16, 2025, 7 PM Live - Watch Streaming Of Winners List Of Dear Super Pearl Wednesday Weekly Draw

Barack Obama addresses divorce rumours as wife Michelle brings him to tears