If fintech has evolved across a wide spectrum in the last decade and a half, so has MobiKwik. Much like the industry, the startup has had its fair share of ebbs and flows and, along the way, it rode the waves that swept through the most significant sector of India’s digital economy.

Starting as a mobile wallet used for recharging cellphones and making bill payments back in 2010, the fintech veteran expanded to buy-now-pay-later services for digital purchases and then to UPI. MobiKwik is now a lending and wealthtech company.

Once a roaring rival to Paytm, is today a quiet warrior. But, what makes the story of MobiKwik interesting is the never-say-die attitude of its parents Bipin Preet Singh and Upasana Taku.

And, it paid off. The fintech startup raised nearly $285 Mn from venture capitalists like PeakXV Partners, American Express and Abu Dhabi Investment Authority until it pulled off one of India’s most surprising fintech comebacks through an oversubscribed IPO, listing at a 58.5% premium.

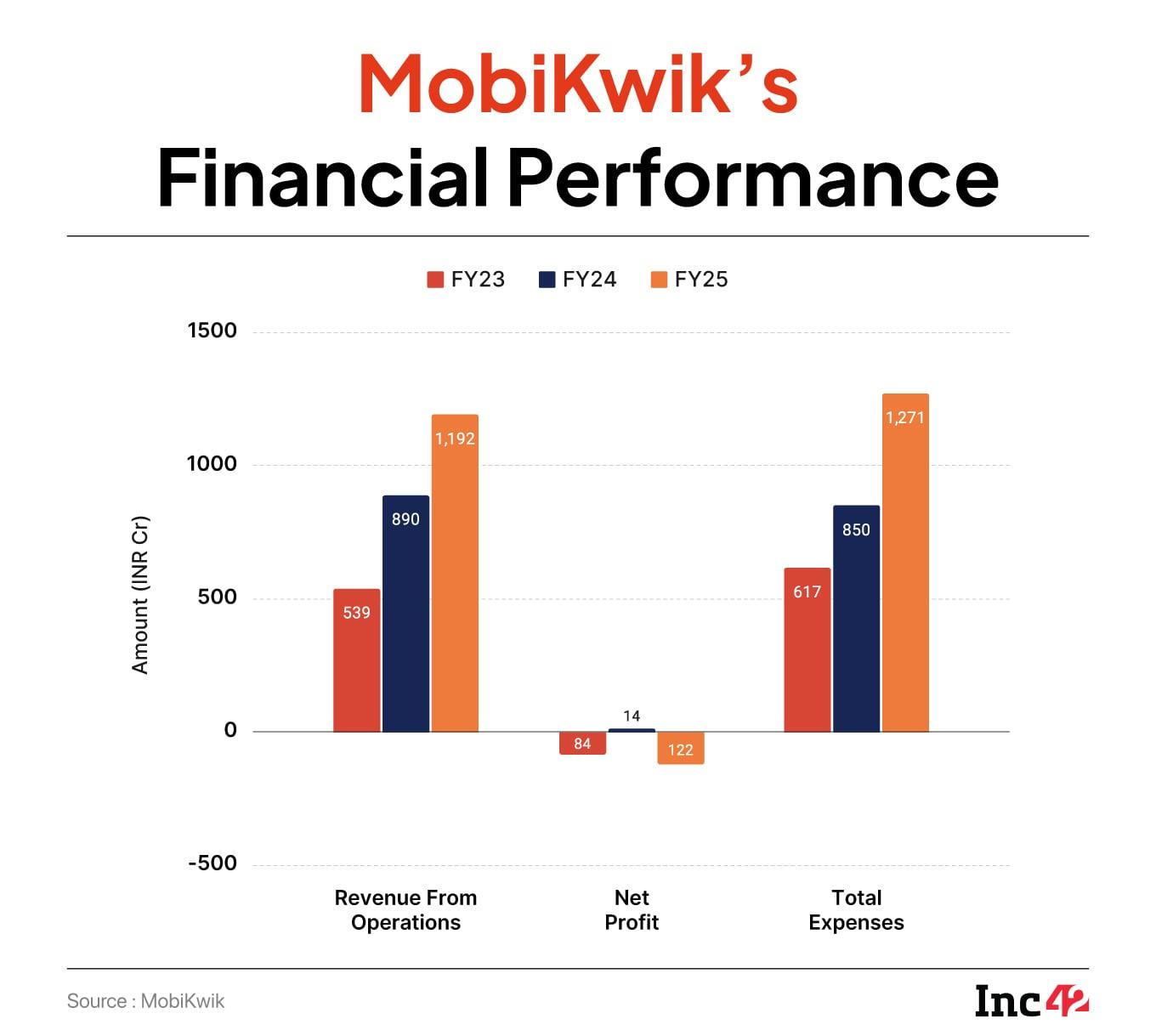

MobiKwik turned profitable in FY24 with a bottomline of INR 14 Cr for the financial year. But, the RBI crackdown on fintech companies later last fiscal drowned most ventures into losses. MobiKwik was no exception.

For the entire fiscal, the company’s revenue surged 34% to INR 1,192.5 Cr, but losses stood at Rs 122.6 Cr. The first quarter of FY26 painted a more challenging picture with revenue down 20.8% on-year to INR 271 Cr and losses ballooning six-fold to INR 42 Cr.

At the recent Global Fintech Festival 2025, Taku sounded bullish on returning to profitability by the second half of FY26 with an overall improvement in performance.

“We broke many records this year. The numbers tell our success story: Achieved all-time high Payments GMV of INR 1,194 Bn, up 80% YoY,” she wrote in a LinkedIn post after the FY25 results.

MobiKwik’s core, according to a fintech analyst with a Big Four firm, lies in small merchants, low-ticket size transactions and, the most critical digital wallet model. The digital wallets were frayed in trysts with advanced digital payments and increasingly stricter RBI regulations, but MobiKwik built its business with the wallet in its core.

MobiKwik dipped its fingers perhaps into all emerging verticals, leveraging the user base of its primary digital wallets business, according to the analyst, who was authorised to speak to the media. Revenue diversification was not an easy task for listed giants like Paytm and PhonePe in a stricter regulatory regime as every move was evaluated by retail investors that in turn swung the market capitalisation.

Then what gives a rather smaller player like MobiKwik the confidence to be back in black in the next few months? Ostensibly, it’s a strategic pivot. Inc42 takes a deep dive.

Wallet Refashioned In The UPI AgeSmartphones had just started gaining traction when MobiKwik entered the fintech space in India back in 2009, as a prepaid payment instrument (PPI) provider, focussed on mobile recharges, utility bills, and DTH payments.

Revenue in this phase was straightforward – commissions from transactions. Merchants paid a small fee, typically 0.5-2%, for processing, while users enjoyed cashback incentives funded by these margins. This model capitalised on India’s cash-heavy economy, especially after 2016 demonetisation, which catapulted digital wallets into the mainstream.

The revenue model pivoted from volume by FY25, when payments formed 73% of the pie. “Our wallet business was built on trust and convenience,” Taku noted in her FY25 reflections, highlighting how features like Supercash, a loyalty programme, boosted retention.

“Payments GMV hit a lifetime high of INR 384 Bn, up 53% YoY, with gross margins at 28% – our best ever,” Singh pointed out during the Q1 FY26 discussions during the earnings call with investors. “This engine relies on scale. Higher GMV (gross merchandise value) translates to more fees with low operational costs once the platform is built.”

The RBI’s regulatory changes tested this model. The central bank’s KYC mandates in 2017 require full disclosures for wallet-service providers, while UPI interoperability in 2022 forced companies like MobiKwik to adapt to the changes, invest working capital to be fully compliant with the evolving regulations while also indulging in innovations.

By the early 2020s, the RBI pushed for PPI interoperability, requiring wallets to integrate seamlessly with the UPI. MobiKwik complied by March 2022, enabling its users to make UPI transactions through third-party apps, which raised transaction volumes and lowered dependency on proprietary systems.

In FY25, the RBI further eased the rules, allowing full-KYC PPI wallets to link directly with UPI handles for seamless payments. MobiKwik responded fast, rolling out Pocket UPI, where UPI payments could be debited from one’s digital wallet, without bank links. The innovation not just sustained revenue, but enhanced it through cross-selling.

MobiKwik emerged compliant and secured a payment aggregator licence for its Zaakpay subsidiary.

Another adaptation came with the RBI’s push for Central Bank Digital Currency (CBDC). In January 2025, MobiKwik launched an e-Rupee wallet for Android users, aligning with the regulator’s April 2024 decision to open CBDC access to non-banks. This not only ensured regulatory alignment, but also positioned MobiKwik as an innovator in digital currency, potentially opening a revenue channel from low-cost, secure transactions.

With multiple RBI licences, including PPIs and payment aggregator, MobiKwik has a strategic edge, allowing it to diversify beyond wallets while maintaining compliance. These navigations have been crucial, as non-compliance could have sidelined the company in a market where UPI dominates 80% of digital payments.

While payments innovation helped MobiKwik face regulatory blows, the startup followed fintech giants like Paytm and others to enter high-margin financial services or lending.

Payments Turn Into Revenue EngineThe UPI headwinds might have been heavy on the wallet, yet MobiKwik didn’t change the core strategy. It started building products for the mobile wallets user base, rather than chasing UPI users.

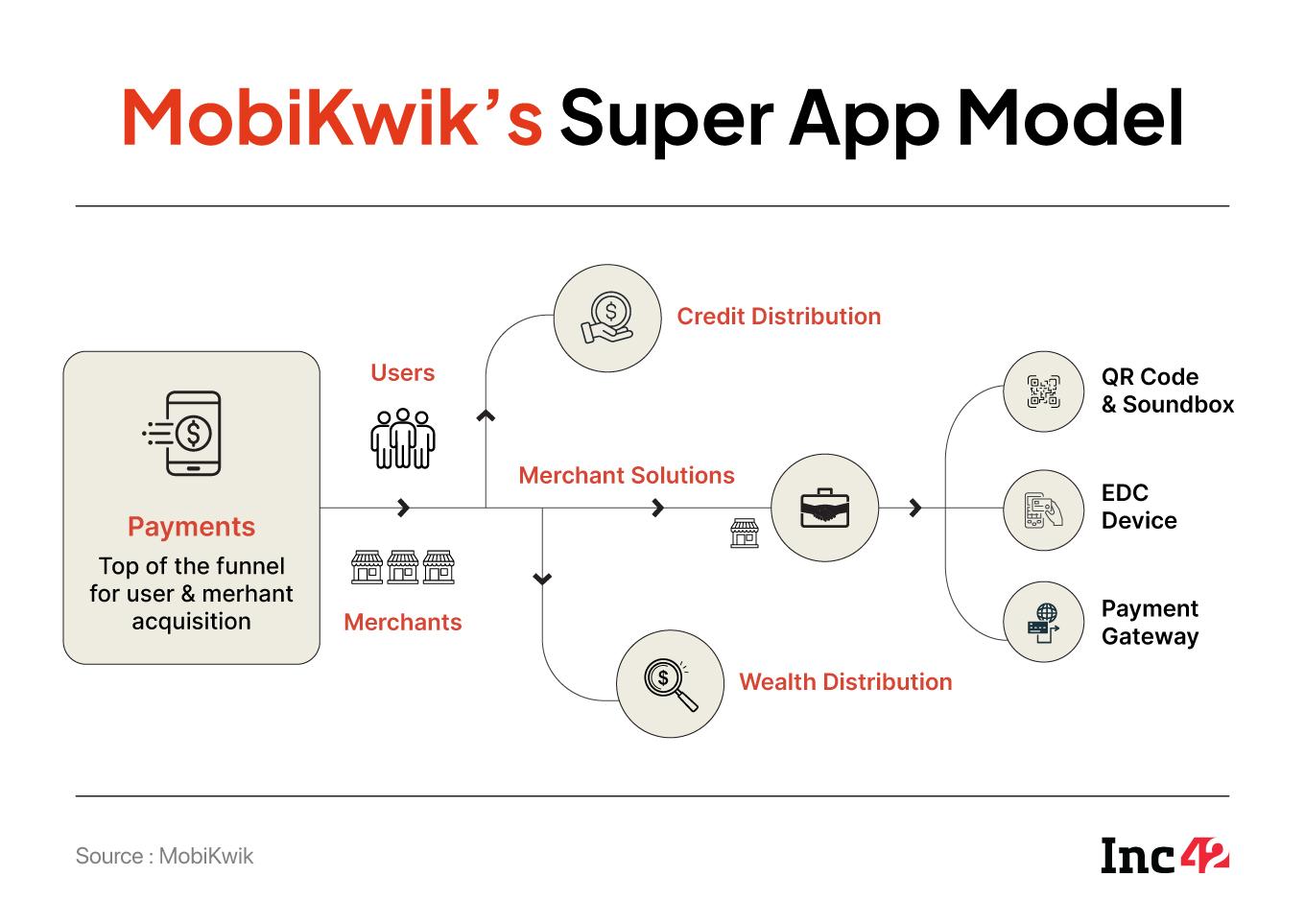

Its payments business operates across three verticals – consumer payments, merchant collections, and business payments through its Zaakpay gateway – all built on the wallet infrastructure. The company boasts of 180.2 Mn mobile wallet users as of June 2025 and 4.64 Mn merchants on the platform.

The June quarter saw MobiKwik’s payments revenue rise 24% over the last year, making up 76% to the company’s overall income. The share of the revenue too shot off from 50% in Q1 FY25 to 76% in Q1 FY26.

MobiKwik charges merchants for services like QR codes, POS integrations, and payment gateways via Zaakpay. Revenue here comes from setup fees, subscription models for premium tools, and higher commissions on high-value transactions.

The fintech firm also charges consumers convenience fees for various digital payments and transactions.

While MobiKwik has seen a substantial growth in the number and value of digital payments on the platform, with highest ever GMV in Q1 FY26, it is focussed on increasing the user base from Tier I and II cities and beyond. “Our payments business saw three times growth in FY25, focusing on Tier II-IV cities, where 75% of new users come from,” Taku said.

Unlike PhonePe or Paytm, which operate on a much larger scale in terms of revenue and user base, MobiKwik is working to build financial products on top of its payments business like cards, investments and loans.

Its FD-linked Rupay credit card, First Card, which the fintech launched in August 2024 for new-to-credit users with no credit score and accepted on all UPI networks is targeted for enabling daily spends for MobiKwik users with no annual charges unlike the usual credit cards.

Despite a much smaller merchant base than PhonePe or Paytm, MobiKwik is pushing for a B2B payments business through Zaakpay – its payment aggregator – and roped in e-commerce mobility companies to explore more revenue channels. Its strong wallet user base has turned into a significant revenue moat for the company.

Mobikwik has also leveraged AI on top of the core payments product to optimise operations and enhance consumer experience. The company said in its Q2 FY26 earnings presentation that AI-driven suggestions and coding tools have created room for increased product testing, higher collections, personalised messaging, and regular follow-ups.

The Agentic AI model being deployed leverages the extensive data of the platform to boost productivity, help in close customer coordination, as well as AI-suggested query resolutions or summaries.

The Pivot To Lending BusinessFintechs forayed into lending around 2018-19. When the pandemic struck, the concept of buy-now-pay-later (BNPL) grabbed the attention of fintech startups. MobiKwik quickly dashed for a slice of the lending pie it had just started tasting.

The BNPL model triggered a surge in small-ticket digital loans of various categories that cheered millennial and GenZ users, who were so far upset with low credit scores. MobiKwik’s BNPL venture Zip targeted underserved consumers with short-term, interest-free loans, earning revenue from merchant commissions and late fees in the early 2020s.

But the deluge of loans fostered a surge in defaults, eventually driving the RBI to crack the whip on unsecured lending. Banks and NBFCs scaled back partnerships, leading MobiKwik to shelve its BNPL play under margin pressure and lender scarcity. This also hit MobiKwik’s financial services business with revenue from the vertical down nearly 50% in Q1 FY26 to INR 58 Cr from INR 170 Cr a year back.

MobiKwik refashioned Zip to roll out Zip EMI for longer-term, installment-based, secured, and mid-ticket credit. This was aimed at a higher take rate of around 8.41% in 2025 and better margins. The company invested INR 9.99 Cr in its NBFC subsidiary, MobiKwik Financial Services Private Limited (MFSPL), in October 2025 to bolster its in-house lending capabilities. The fintech firm also hopes to lower the costs associated with loan disbursals by improving collection efficiencies.

The startup offers small-ticket loans to its existing network of retailers to build loyalty and generate revenue. Merchant lending comes with its own challenges, yet bigger players like Paytm and BharatPe nurture this business to secure sustainability.

An expanding lending portfolio, better leveraging of user data for personalised credit, and reducing reliance on external lenders are expected to help MobiKwik pull off profitability this fiscal.

Wealthtech, Stocks New Growth LeversInvestment tech and advisory have emerged as a growth lever by default for mature fintechs with the likes of Zerodha and Groww leading the league. Although the wealthtech space has come under strict regulatory scrutiny by the markets watchdog SEBI, products like mutual funds, SIPs and equity trading have attracted a lot of traction among the digitally savvy consumers.

Since its acquisition of online mutual fund platform Clearfunds in 2018, MobiKwik has slowly seasoned its wealthtech wing to mature into its third engine of revenue. The idea behind this business vertical, as Taku stated earlier, is to introduce investment as a product to the Tier II and III towns where the wealthtech penetration is abysmal.

While MF distribution draws income from commissions, the recently bagged stock broking licence from SEBI will allow it to scale the consumer side of the business by offering demat accounts and trading portfolio tools. Unlike payments and financial services, cracking the wealthtech markets beyond metros calls for more on-ground workforce deployment for consumer outreach which, in turn, adds to the cost load.

MobiKwik stays bullish on the stock broking vertical and sees it as an important growth lever, despite the challenges.

On The Road To Regain ProfitabilityAn Inc42 analysis earlier this year found that the uphill climb for MobiKwik got steeper with its Q1 FY26 topline looming 18.6% from the last year to INR 281.6 Cr, cost control mechanism going full throttle, and widening distance with rivals like Paytm and PhonePe.

As the company stretched its ambit from loans to broking, MobiKwik now bets big on the next billion digital users, but racing against deep-pocket incumbents with just a little over INR 300 Cr in hand is a bold, uphill play.

With its eye on profitability in the second half of this fiscal, MobiKwik picks its growth levers in AI, product innovation, user stickiness, and insurance foray. The startup hopes to derive a larger slice of merchant’s business through Zaakpay and the NBFC arm, which will give it better control over margins in lending and firms up the focus on Tier II and III cities.

Is the business blueprint robust enough to take the fintech unicorn to its target profitability? The hurdles are numerous.

Tightening of the regulatory regime isn’t over yet with frequent reports of unlawfully high interest rates charged by non-bank financiers, spurious lenders violating laws to recover dues from defaulters, and deadly debt traps spread across the fintech landscape that’s well on course to reach $250 Bn in terms of revenue by 2030.

An increasingly crowded marketplace with only two-three giants controlling more than 87.5% of the online payments space, smaller players face a tough time on the turf. Larger rivals like PhonePe and Paytm have bigger ecosystems, but MobiKwik sits on a formidable foundation of its digital wallet business.

In 2018, when most industry watchers had written off MobiKwik as a relic of the wallet era, few had predicted that it would churn out one of the first profitable fintech IPOs of the decade. And, that’s precisely what it did – not by chasing valuation, but by building fundamentals.

MobiKwik’s journey from a digital wallet to a diversified financial platform mirrors the maturing of India’s fintech ecosystem from transaction-led growth to sustainable monetisation.

[Edited By Kumar Chatterjee]

The post MobiKwik 2.0: Can The Wallet Veteran Finds Its Fintech Mojo Again? appeared first on Inc42 Media.

You may also like

AIIMS Bhopal introduces PAE as safer alterative for Benign Prostatic Hypertrophy management

Football: Liverpool, Manchester United looking to build on wins in Premier League

Exclusive: Is Baseer Ali out from Bigg Boss 19 in double eviction?

Abu Dhabi rolls out variable speed limits on Sheikh Zayed Road: What motorists must know about the new system

Arunachal: BRO's Project Arunank celebrates 18th Raising Day at Naharlagun