Supply chain solutions provider LEAP India filed its draft red herring prospectus (DRHP) with SEBI last week to raise INR 400 Cr through a fresh issue of shares. The initial public offering (IPO) will also include an offer for sale (OFS) of up to INR 2,000 Cr, taking the total issue size to INR 2,400 Cr.

Through the OFS, promoter KKR-owned Vertical Holdings II will sell shares worth up to INR 1,998.6 Cr, while promoter group entity KIA EBT Scheme 3 will offload shares worth around INR 1.38 Cr.

The 469-page DRHP also provides insights into LEAP India’s ownership patterns and key leaders. At the time of filing, the promoters and promoter group together held 95.7% stake in the company. Vertical Holdings II Pte. Ltd. led with a 73.9% stake, followed by founder, chairman and MD Sunu Mathew with 21.3% stake.

Among institutional investors, Sixth Sense Ventures (via Sixth Sense India Opportunities III Fund) owned 1.4% stake, while First Bridge Investment (via First Bridge India Growth Fund) held a 1.2% stake.

Madhurima International, operating in specialty finance and commodity trading, also held 1.01%.

Founded in 2013, LEAP India positions itself as the country’s largest on-demand asset pooling provider in supply chain management. It offers pallets, containers, and other material handling equipment that help clients cut costs and improve logistics efficiency. Instead of owning and managing their own assets, companies can lease and return them as required.

The company serves sectors such as FMCG, beverages, ecommerce, automotive, and retail. It claims to have 8.8 Cr pallets and 40,000 containers in circulation, supported by a network of 20+ warehouses and service centres nationwide.

On the financial front, its operating revenue grew 27.8% to INR 466.4 Cr in FY25 from INR 364.9 Cr in FY24. Net profit remained flat at INR 37.5 Cr compared to INR 37.1 Cr in the previous year.

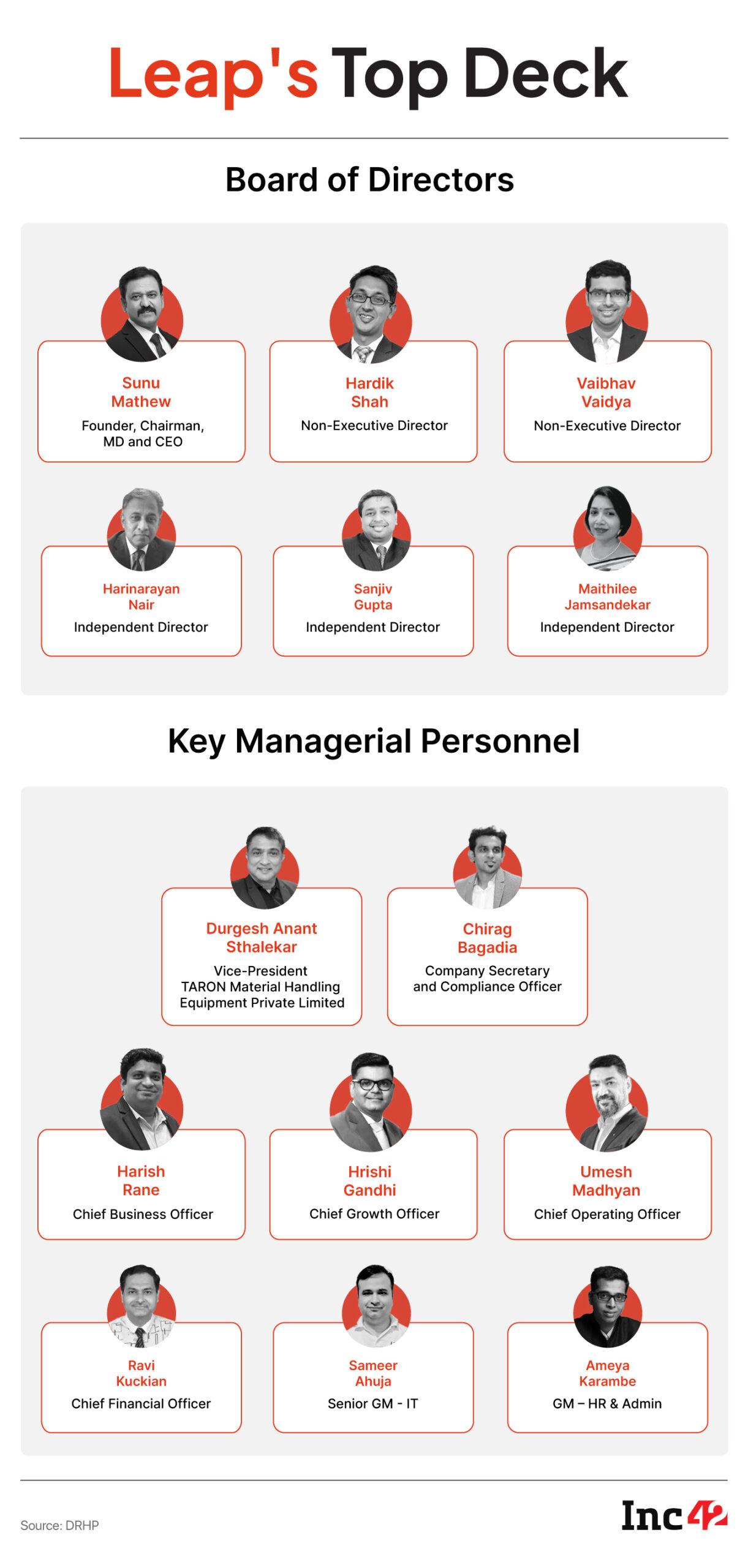

Now, let’s take a look at the company’s board of directors and key executives.

Decoding LEAP India’s Leadership Team

Mathew is the chairman, managing director and chief executive officer of the company. He has over 26 years of experience and has previously worked with CHEP India and L’Oréal India. His remuneration will be INR 17.96 Lakh per month in FY26.

Hardik Bhadrik ShahShah is a non-executive director at the company. He is currently a partner at the Asia-Pacific Infrastructure team at KKR India Advisors. Shah didn’t receive any pay in FY25.

Vaibhav VaidyaVaidya is a non-executive director. He is designated as director at KKR India Advisors and has earlier worked with KKR India Asset Finance, Motilal Oswal Investment Advisors and JM Financial Credit Solutions. Vaidya didn’t receive any pay in FY25.

Harinarayan Nair SreedharanSreedharan is an independent director at the company. He has around 28 years of work experience and has held leadership roles at Signode India and Wipro PARI, where he last served as vice-president.

In FY26, he is entitled to a sitting fee of INR 50,000 per board meeting, INR 25,000 per committee meeting, along with a profit-linked commission.

Sanjiv GuptaGupta is an independent director. He has previously served as CEO of Spice Xpress and Logistics and held leadership roles at Coca-Cola India.

In FY26, he is entitled to a sitting fee of INR 50,000 per board meeting, INR 25,000 per committee meeting, along with a profit-linked commission.

Maithilee JamsandekarJamsandekar is an independent director. She has over 17 years of experience and has worked with A-1 Fence Products, PwC India, Thoughtworks Technologies and Mahindra & Mahindra.

In FY26, she is entitled to a sitting fee of INR 50,000 per board meeting, INR 25,000 per committee meeting, along with a profit-linked commission.

Key Managerial Personnel Ravi KuckianKuckian is the chief financial officer of LEAP India. He has over 17 years of experience and previously worked with Johnson & Johnson, SUN Mobility as head – finance, and CHEP India as finance controller. In FY25, he drew an annual remuneration of INR 45 Lakh.

Chirag BagadiaBagadia is the company secretary and compliance officer. He has close to 17.5 years of work experience, having previously worked with Inspira Enterprise India as assistant vice-president, Music Broadcast as deputy general manager and Ackruti City as manager-secretary. He received a remuneration of INR 21 Lakh in FY25.

Harish Vasant RaneRane is the chief business officer at the company. He has more than 21 years of experience and earlier worked with Kellogg India, Mattel Toys (India), Ferrero India and L’Oréal India. In FY25, he drew a remuneration of INR 80 Lakh.

Hrishi GandhiGandhi joined the company as its chief growth officer earlier this year. He brings over 24 years of experience in the financial services sector, having previously worked with Yes Securities (India), NewSpace Research & Technologies, IL&FS Global Financial Services (ME) and ICICI Bank. He joined the company in FY26.

Umesh MadhyanMadhyan is the chief operating officer at the company. He has more than 24 years of experience and previously worked with Hindustan Coca-Cola Beverages, Heinz India and L’Oréal India. In FY25, he received a remuneration of INR 63 Lakh.

Durgesh Anant SthalekarSthalekar is the vice-president of the company’s subsidiary, TARON Material Handling Equipment. He has more than 20 years of experience and earlier worked with L’Oréal India and Fareast Mercantile. He drew a remuneration of INR 58 Lakh in FY25.

Sameer AhujaAhuja is the senior general manager – information technology at the company. He has 19 years of experience, having worked with UltraTech Cement, Reliance Retail, Trent, Cognizant, Raymond and Aditya Birla Retail. In FY25, he received a remuneration of INR 49 Lakh.

Ameya Vijay KarambeKarambe is the general manager – HR, admin and learning at the company. He has more than 8 years of experience and worked with Mahindra & Mahindra, Kanakia Space Realtors, HDFC Asset Management and Carnival Capital earlier. In FY25, he received a remuneration of INR 36 Lakh.

The post LEAP India DRHP: A Look At Shareholding Pattern & Key Executives appeared first on Inc42 Media.

You may also like

Enzo Maresca sent exciting message by £44m Chelsea signing he is yet to use

Casualty viewers 'broken' as BBC medical drama airs shocking death scenes

Celtic release unprecedented 1,030-word transfer statement after huge backlash

'Not responsible for Dhinakaran's exit from NDA': Tamil Nadu BJP Chief Nainar Nagendran

Himachal govt removes Rule 7A from Civil Services Revised Pay Rules, may spark employee protests