More than 5 Mn people turn to ixigo every day to buy their railway tickets or to track the movement of trains. India has left the glitchy IRCTC experience behind, if ixigo CEO Aloke Bajpai is to be believed.

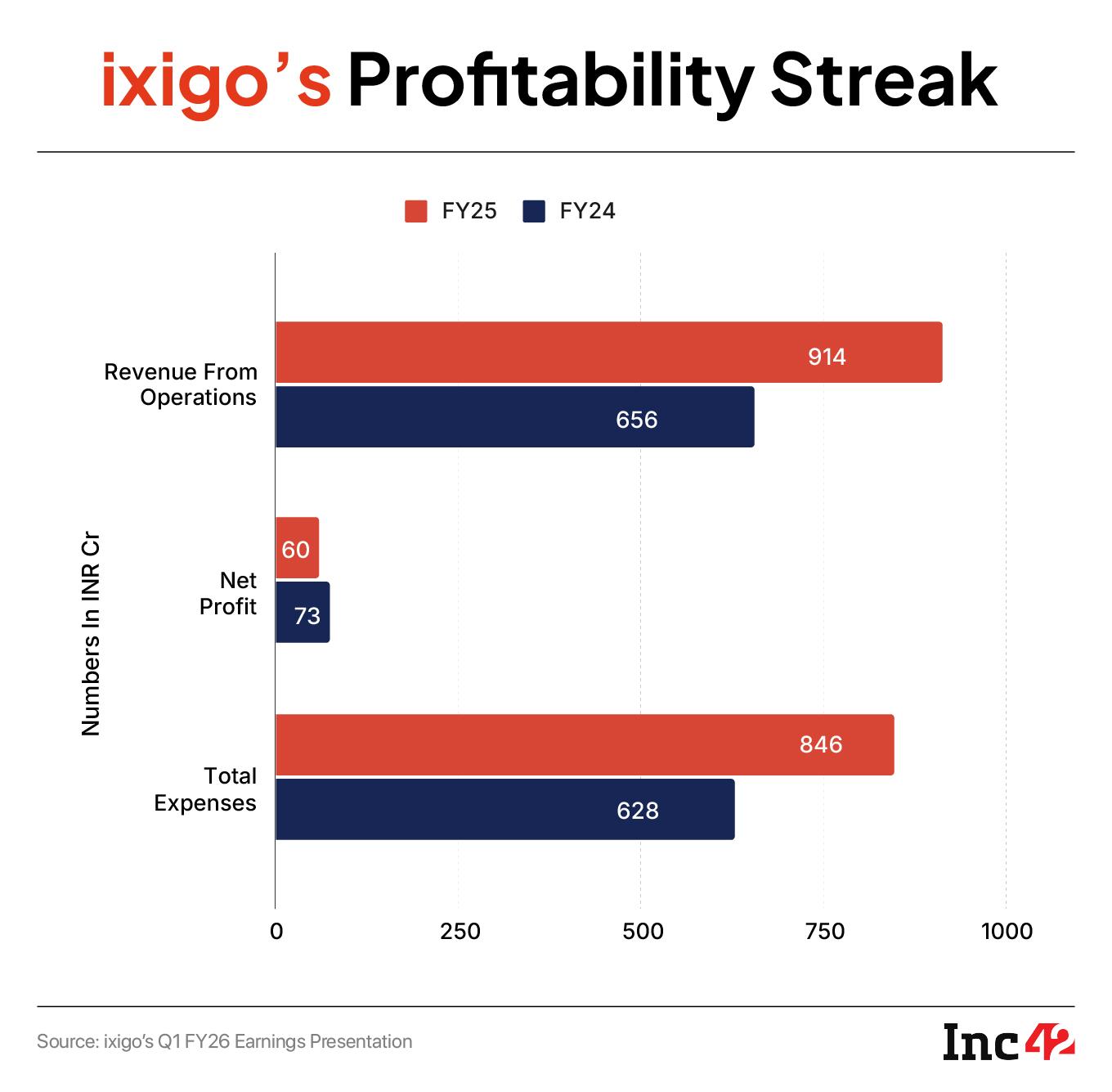

The OTA platform ended FY25 with a record business of INR 914.2 Cr.

In the bustling ecosystem of platform-driven businesses, ixigo has probably resolved one of the biggest real-world hurdles in India – commuting by train. “Our success stems from our deep-rooted commitment to delivering seamless travel experiences,” chairman and CEO Bajpai said in the ixigo earnings report.

Is the platform taking quiet steps to emerge as a giant in India’s $23.10 Bn online travel market that’s chugging at 7.76% annually to reach $33.90 Bn by 2030? Trust millennials and Gen Zs – the emerging growth engine for the country’s $2.4 Tn consumer market that’s pacing up to be the world’s second largest at $4.3 Tn by 2030.

Out of the 715 Cr passengers who travelled by train in FY25, a record 81 Cr had reserved tickets. Online penetration in train bookings is expected to increase by 86%, faster than air tickets or hotel bookings, where the growth is pegged at 81% and 46%, ixigo said in its investor presentation for the first quarter of this fiscal.

This is the result of 1 Bn-plus smartphone-clad consumer market in a country of 1.4 Bn people, where 24 Mn passengers and 3 Mn Tonnes of freight travel every day by the world’s fourth-largest railway network spanning over 135,000 Km.

And, ixigo was catapulted to be the largest travel tech player in the train booking space, cornering 51% of the market share in the online train ticketing space, along with Confirmtkt. In FY25, 40-50% of its annual revenue came from this vertical alone.

But the journey for the the rail-focused online travel agency (OTA) that had started off as a flight and train search app in 2007 and partnered with IRCTC to add value-added services, acquired smaller travel tech players and boasts off a transaction volume of nearly INR 15,000 Cr hasn’t been a smooth ride.

An increasingly crowded travel tech space in India has the giants like MakeMyTrip, EaseMyTrip and Yatra with their financial prowess and diversified businesses. The discerning Indian traveller is also turning towards cheaper air travel to save time. Compared to the mightier rivals, ixigo’s disciplined approach to profitability, AI-driven personalisation, and ‘Built for Bharat’ ethos have delivered superior returns and, in turn, set the share price soaring over 200% since the startup went public in 2024.

Inc42 tracked the listed travel tech firm’s growth trajectory to understand its playbook and estimate the challenges as it laid out the blueprint to be the next travel giant.

Financials Going Full SteamA look at ixigo’s financials for FY25 and of Q1 FY26 reflect that while the travel company chased hyper-growth through investments in hotel booking, air ticket booking and train food delivery services, it showed fiscal prudence in a market where some of its rivals grappled with soaring losses.

Its FY25 results painted a picture of robust expansion with revenues climbing 39% to INR 914.2 Cr and adjusted EBITDA surging 71% to INR 94.8 Cr, culminating in a 128% leap in post-tax profit over the previous year. This momentum spilled into Q1 of FY26, when the topline zoomed 73% to INR 314.5 Cr and bottomline 76% to INR 28.7 Cr.

In FY25, the company’s gross transaction value (GTV) hit a record INR 14,972 Cr, rising 65% on-year, propelled by a 183% surge in flight bookings and steady dominance of rail journey. Contribution margins rose 69% year-on-year in Q4 with optimised marketing spends and higher ancillary uptake (insurance and hotels) at 35% of revenue.

“In FY25, we not only recovered but redefined growth through innovation, achieving INR 914 Cr in revenues while maintaining EBITDA margins above 10% – a testament to our low-capex, tech-first model,” Bajpai said in the earnings report.

The company’s AI-powered personalisation, like predicting train delays, boosted conversion rates by 20%. “App users surged 35% to 50 Mn monthly active users, with Tier II and III penetration at 60%, underscoring the ‘Built for Bharat’ playbook,” he added.

The platform is raising INR 1,296 Cr from Prosus through a preferential issue on a private placement basis to fuel its growth further. The numbers are robust enough to threaten any online travel aggregator. But what lies behind the numbers? It’s ixigo’s Flywheel strategy, which spreads it in the entire travel funnel of budget travellers and makes inroads into luxury segments.

The Flywheel Strategy On TrackEven though Ixigo’s larger market includes Tier II and III towns and beyond, the company has been at the forefront in terms of adoption of AI to simplify user experiences, bring value-added services and cross-sell other businesses.

In Q1 FY26, almost 88.8% of the customer queries were solved by ixigo’s AI chatbots. The company leveraged Generative AI further to make creatives that optimised spending.

The company integrated its diversified businesses into the flywheel model. In February 2021, ixigo acquired ConfirmTkt, a Bengaluru-based train booking app and, later in August, it bought AbhiBus, a Hyderabad-based intercity bus ticketing platform. It went on to acquire Zoop in 2024, a train food delivery and e-catering startup.

An integrated app ecosystem, comprising ixigo, ConfirmTkt and Abhibus, have also unblocked revenue streams where the apps can cross-sell each other’s services and offer value-added services, and loyalty programmes.

Bajpai sounded bullish on fresh investments into air travel and hotel booking, even though budget travel has been the key growth driver for ixigo’s revenues and despite simmering competition from more seasoned international player MakeMyTrip, listed players like Yatra, EaseMyTrip and Flipkart-backed Cleartrip.

Riding The Gravy TrainThe listed travel tech startup has always banked on a rail-centric moat in India’s INR 2.70 Lakh Cr train travel market, with more than 40% business concentrated in this vertical. In Bajpai’s own words, it was a conscious decision to build the business model around Bharat, where flight services make up just about 4-4.5% of the daily travel.

Rail booking is basically a volume-led, stable-margin revenue lever which has thrown open a predictable revenue stream for ixigo, where the operational expenses are also not high. Bookings, especially through OTAs like ixigo, rely on the IRCTC platform of the Indian Railways for inventory, eliminating the need for aggregators to hold or manage physical assets. This results in minimal variable costs beyond tech infrastructure and marketing.

IRCTC offers fixed commissions plus convenience fees, yielding a steady 5–7% take rate. Take rate is basically the revenue earned by an OTA like ixigo for every ticket booked through the platform. In Q1 FY26, ixigo facilitated 26.6 Mn rail ticket bookings as against 2.79 Mn flight bookings and 6.7 Mn bus ticket transactions.

Under rail bookings, the customer acquisitions are mostly organic, which eliminates the need for huge marketing spend. Over the past few years, ixigo has also leveraged its stable core business to cross-sell bus bookings, food-on-train and travel guarantee services.

While rail bookings gave it a stable revenue stream, flight bookings with a higher take rate of 9.2% and bus bookings with a take rate of 12.2% are the next revenue levers for ixigo. The company saw 81% growth in flight booking business in Q1 FY26, which contributed 32% to its revenues for the quarter, indicating an improvement to move towards a healthy revenue mix.

Scaling in the flight business is likely to be challenging for ixigo, where it needs to cater to a relatively premium segment and the travel frequency is not as high as train. Unlike train business, flight booking is a crowded space with players like MakeMyTrip, Cleartrip and EaseMyTrip building their models around flights and ancillary hotel and travel assistance revenues. These platforms also cross-sell value-added services like seat selection, travel insurance and baggage protection.

Despite operating on a smaller revenue base, ixigo has shown a stronger growth momentum in this vertical than its peers.

Bus booking contributes least to the overall revenues, making up 24.4%, but clocks the highest take rate for ixigo. It is closely related to its rail booking vertical and is a major profitability driver. Despite low-ticket size in bus bookings, ixigo has been able to leverage its partnership with bus operators, integrate with its subsidiary Abhibus to control the market and cross-sell to train travellers.

And, The Competition Is TrackingWhile Nasdaq-listed MakeMyTrip’s revenues soared 25% on-year to $973 Mn (INR 8,166 Cr) in FY25, EaseMyTrip stayed flat at INR 587 Cr, while corporate travel-focussed Yatra’s international acquisition and robust client addition fuelled an 87% surge in business to INR 791 Cr.

An Inc42 analysis of the financials of ixigo and its rivals signal that while EaseMyTrip may have seen a decline in revenue in FY25, its margins at 24% were highest in the OTA segment. It was, however, pipped by ixigo in terms of business growth, with a margin of 10% in FY25 and sustained momentum in Q1 FY26. For ixigo, the topline shot off 76% in Q1 FY26, while EaseMyTrip suffered a 25% decline.

Yatra is also closing in on the revenue gap with Ixigo with 108% surge in Q1 topline on the back of its B2B synergies and acquisitions.

MakeMy Trip continued to be the largest player in terms of revenue scale, reporting healthy margins of 17% in FY25 with robust hotel bookings, premium travel services, and international expansion driving the growth.

Sharp Bends And Red FlagsThe sky is getting crowded by the day for a slice of the lucrative air travel business pie, even as international flights turned at least 13% costlier and domestic airfares surged 38% between 2019 and 2025, making market expansion a hard task for OTAs, especially ixigo, which is focussed on Tier II cities and beyond.

The regulatory risks and any rules that cap the margins, or make convenience fees and take rates, and refund processing stricter for airlines or OTAs can cause disruption in this segment of the business. The heat of geopolitical fare-ups have also scorched OTAs in running their businesses either by jacking up the fuel prices or making skies unviable for safe flights.

Rail bookings, ixigo’s mainstay, face the biggest hurdle in weather conditions that often disrupt train travels. Lack of an exclusive tie-up with IRCTC for online ticket booking and absence of entry barriers for the new players too can be a challenge for the travel tech platform.

A late entry in the hotel booking business makes it challenging for ixigo to compete with well-established players with a healthy inventory of hotels, exclusive tie-ups and holiday bundled packages on offer.

The ascent of a train tracker to a travel tech titan reinforces its rail-centric moat and strategic diversification, underpinned by the ‘Built for Bharat’ ethos that resonates with India’s next billion users. Despite competitive and regulatory challenges, its AI-driven efficiency and multi-modal flywheel strategy make it fit to challenge MMT’s scale and EMT’s margins.

[Edited By Kumar Chatterjee]

The post ixigo Is Quietly Ascending To Become The Next Travel Giant appeared first on Inc42 Media.

You may also like

Another blackout in Ukraine: Russia fires over 300 drones, 37 missiles; disrupts power in 8 regions

Pakistan says ready to talk to Afghanistan on our terms

US strikes another 'drug-carrying' boat in Caribbean; survivors expected - report

Bison Twitter review: Netizens hail Dhruv Vikram's powerful performance, call Mari Selvaraj film 'hard-hitting'

Sensex surges close to 900 points